Automation Is Not The Final Stop. For An Invisible Bank, Autonomous Is The Next Step

Author: Vinith Basani, Solutions Consultant, Profinch Solutions

HOW THINGS ARE

“Banking is necessary but, banks are not” – is a heavily used, timely quote, and it is where I see the trend going.

The world of INTERNET has brought in a lot of positive changes over the last few years. Internet is no more a premium service, instead, it has turned out to be a daily need for people across the globe. The drastic shift in technology and affordable data forced enterprises to provide services to consumers at their fingertips. In few years, banking will be entirely behind the scenes, running in the background and embedded in everyday activities.

The marriage of data and intelligence gives rise to game-changing opportunities and explosive threats. Today, two out of three new deposit accounts opened online are direct, non-traditional using cloud-based services.

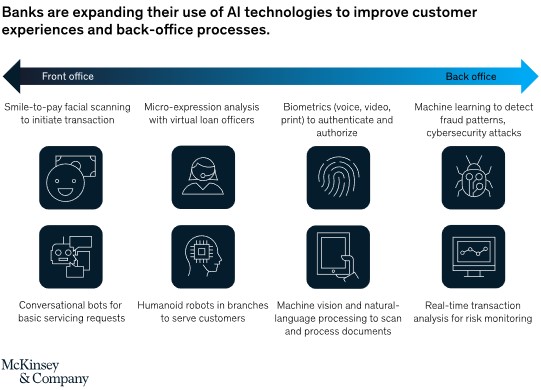

Digital banking technologies — including artificial intelligence, machine learning, deep learning, analytics, personal financial management, mesh networks, human augmentations, internet of things, voice banking, gesture recognition, banking as a service, fintech innovation etc., are converging towards one end goal: Autonomous and invisible banking.

AI is the New Tomorrow

Start talking to IoT devices

Soon, you’ll make everyday purchases via voice on a smart assistant built into your home and smartphone. 40% of Millennials are already using voice assistants to make purchases, and this number is expected to exceed 50% by 2020-21.

Today, in most developed economies, more than 50% of customers use their mobile for checking their balance versus any other bank channel. Twenty years ago, this feature was dominated by ATM or phone banking. In 10 years, it will be dominated by voice-based commerce engines.

Gazing into the near future:

Consumer 1: “Alexa, what’s my account balance?”

Consumer 1: “Siri, has my salary hit my account yet?”

Our frequency of talking with our bank via Google, Alexa or Siri will increase exponentially. We would enquire things like, when can we go out for dinner; or, at my current rate of savings, when can I afford a deposit on a house or buy that replacement vehicle; or, what do I need to do to pay down my credit card debt faster. Voice will combine natural language, search and AI to provide answers to these questions much faster than through a branch or web channel.

The seamless nature of voice will force us to create compelling, frictionless experiences where advice and utility blend together. The movements toward ‘open banking’ will give Google, Apple and Amazon exceptional abilities to incorporate this data into voice assistants. You won’t even need bank applications. These will likely become native services within the next 10 years. A few examples of how effective and useful future voice communications would be:

Alexa: You can’t afford to buy a new car right now, but if you sign up for Uber today, Uber will cover half of the next two years’ lease payments. You just need to agree to drive for Uber at least four hours a week. Is this something that interests you?

Siri: You are paying too much using a credit card today. I have other options for financing that could save you $230 per month that I could automatically link to your Apple Pay wallet. Would you like to see them?

Like we trust Wikipedia or Google search today; soon, voice will lead to customers learning to trust their AI assistant to recommend day-to-day financial solutions, rather than looking for it themselves. This extends to bank employees as well. For example, bank CEO may ask voice enabled applications:

- What is revenue in the last quarter?

- What is the performance of products in the last quarter?

- What is the projected revenue for the next quarter?

Let us suppose that a bank doesn’t start thinking about digital bank account accessibility through voice & mobile as their primary channel for day-to-day access and advice to their customers. In that case, banks will be caught off guard in the same way they were when both internet and mobile apps first appeared. This time though, the risks are more significant because the shift from product to experience will dramatically erode the ability to retrofit voice onto the existing channel middleware or bank’s core system architecture.

Connected devices give more insights – Mesh Networks

Alan McIntyre, Senior Managing Director for Banking at Accenture, expects payments to move away fully from cards and phones toward wearables and biometrics by 2025. “Whether it is tapping a ring that you wear or facial recognition, the payment will become more seamless,” he said and added, “The idea of taking the card out of the wallet will seem archaic. What you think of as transactional banking will disappear.”

Using a Mesh Network topology, automation can be implemented without the worry of future layout changes. The mesh network with IoT will open up opportunities for Artificial Intelligence (AI), a large market on the cusp of exploding.

Banks can utilize IoT technology to expand their offered range of services to their customers beyond the traditional ones. For instance, U.S. Bank started using IoT initiatives to help motivate their customers to stay fit. When the client completes certain tasks, they are granted bonuses and financial rewards. Wearing IoT devices for payments and biometrics for transactions helps foster a strong relationship between the bank and the customers. It makes customers feel that their bank cares about their daily needs.

The increased usage of devices by bank customers has increased the usage of IoT data. Banks are now using IoT data to transform their customer experience by offering customized services and products. Banks can offer tailor-made medical and health services by utilizing data like health, location service, app usage etc., to analyze and comprehend the complex behaviour of the customer. Banks have to convert the data they gather from IoT into valuable information that helps them make informed decisions. Through the information obtained, banks can increase their market share while also providing better services to the customers.

APPROACH FINANCIAL INSTITUTIONS SHOULD ADOPT

First and foremost, banks should get comfortable working with cloud technologies and digitizing most of their customer journeys. They can have a private cloud connected to bot services. Choosing automation technologies built for purpose will have faster operational capabilities. In almost all instances, the reality is that the cloud will be quicker and more secure than a bank’s internal, on-premise architecture.

Secondly, the bank needs a data pool that can allow queries from a multi-channel layer. The data pool will need cross-silo data integration, also called a 360-degree view of the customer. But this is more about anticipating natural language queries and customer behaviour where a multi-channel event might be triggered.

Thirdly, banks will need broad data-based and technology-based partnerships that lead to better integration of their financial services capability into real-world and real-time scenarios where they can add value easily.

Finally, banks will need multi channel-based and behavioural-based design teams. The teams need to be familiar with how people are using voice technology in their day-to-day lives. They need to understand IoT and where technology fits into their life.

These are newer skill sets and cultural changes in banks. It is not mystery shopping like one of the investment products or trying to come up with demographic-based or psychographic-based credit card offers. It is behavioural gamification, economics and psychology as design competencies.

In the AI world, ISVs are experiential solutions providers. The solution shouldn’t push an offer for an existing bank product down a new channel because if this is the case, the solution is not meeting the expectations of the newer generation. The only way AI will work for banks as a business tool is by accepting engines like Alexa, which will be the bank’s voice extension—but will only work conversationally. Pitching a product that the customer doesn’t need immediately, will make the bank lose access to the channel because the customer may block the bank as this doesn’t excite them. The key skill will be to anticipate customer needs and responding in a frictionless manner, whether via voice, mobile, in an augmented reality head-up display (smart glasses circa 2022–25) or similar platforms.

“Bottom line, having a customer- centric culture is more than just a good thing – its matter of survival” – Jim Marous