Banking in the Metaverse: Virtual Reality Empowering Banking Experience

Introduction

In the realm of technology, virtual reality is a prevalent topic, but what does it have to do with banking? Everything. The term “metaverse banking” relates to the management of financial transactions in virtual environments. This implies you can teleport from your living room to any bank in the world and conduct business without ever leaving your home!

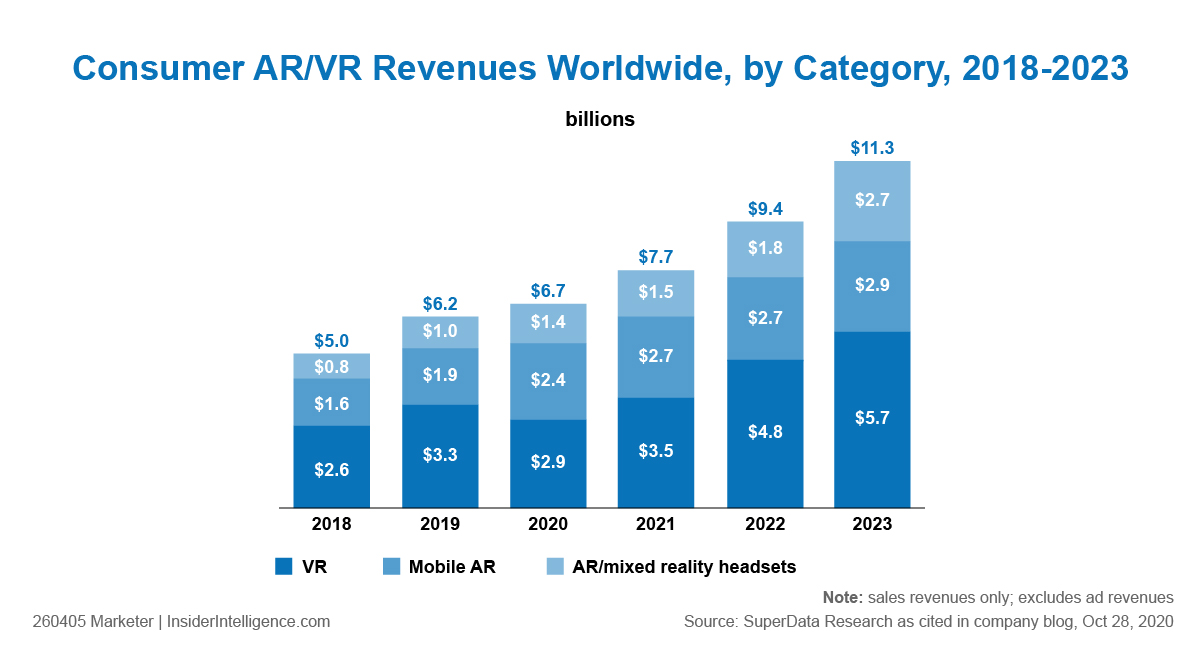

Banks have been using virtual reality for years, but now that VR headsets are becoming more inexpensive, this technology has the potential to revolutionize the way we think about banking forever.

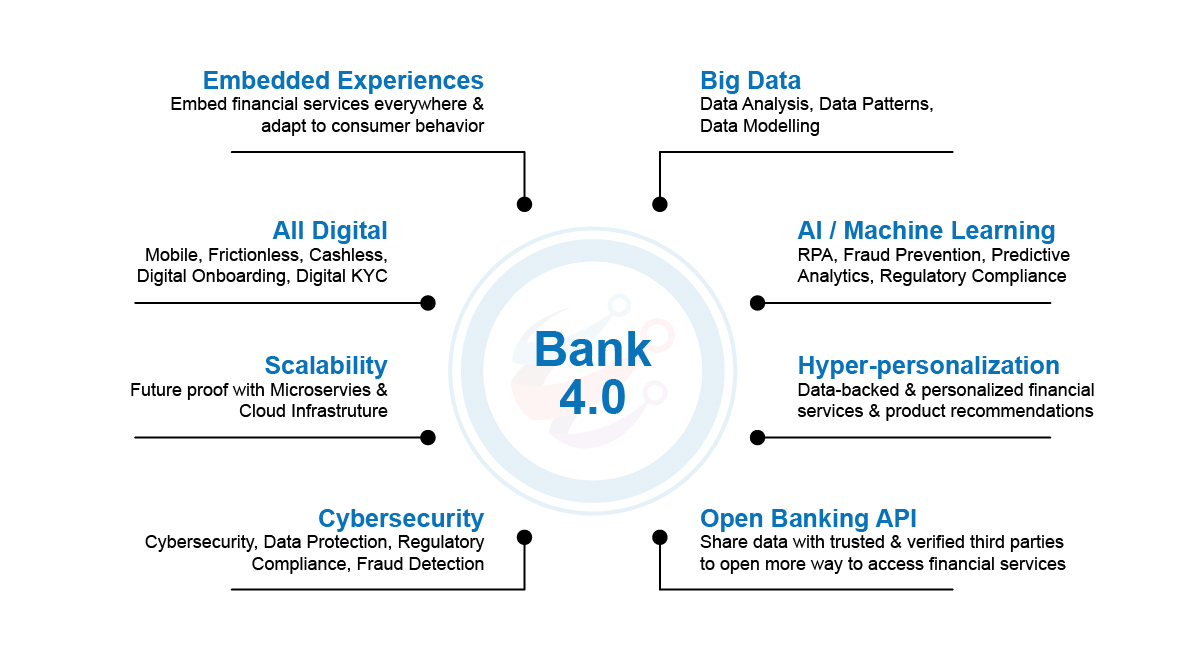

Virtual reality is the future of digital banking. With metaverse, financial transactions can take place in this virtual world which will create an unparalleled customer experience. Banks are looking at virtual reality because it has the potential to change the way people bank and interact with their money. Banks will increasingly adopt virtual reality (VR) technology as they explore immersive technologies that could offer up new ways to engage customers via mobile devices or PCs, provide a better understanding of complex data, and even better educate personnel.

Keep reading!

What is the Metaverse?

Use Cases: The metaverse is a virtual reality platform, where users can create and customize their own avatars. In addition to that, the metaverse would allow seamless interaction between digital objects in this simulated world. Because of its technology capabilities, it will be able to not just make online shopping but also live events more fun and engaging for all types of clients from the banking sector. Now imagine how your bank could look like in there? Will you have an avatar or some kind of digital self-representation? It looks very similar to “Ready Player One” movie by Steven Spielberg with his OASIS meta-universe; we are surely heading towards such an option when talking about banking!

Managing financial transactions in the ‘Metaverse’

What does the new buzzword “metaverse” signify for banks and financial institutions? Metaverse could be a virtual environment where the only restriction is one’s imagination. It could also be a less-than-desirable place for holding business meetings at home. Banks and financial institutions, like any other industry, have the potential to expand their operations significantly. They can offer a digital banking experience that is unconstrained by traditional geographies, time zones, or even regulatory boundaries.

Financial institutions can create new customer experiences and product offerings in virtual worlds that go beyond the constraints of our physical world. Transactions that were once impossible or too costly to conduct become feasible in a metaverse environment. For example, imagine being able to purchase an asset on one continent and have it delivered to you on another without ever having to leave your home!

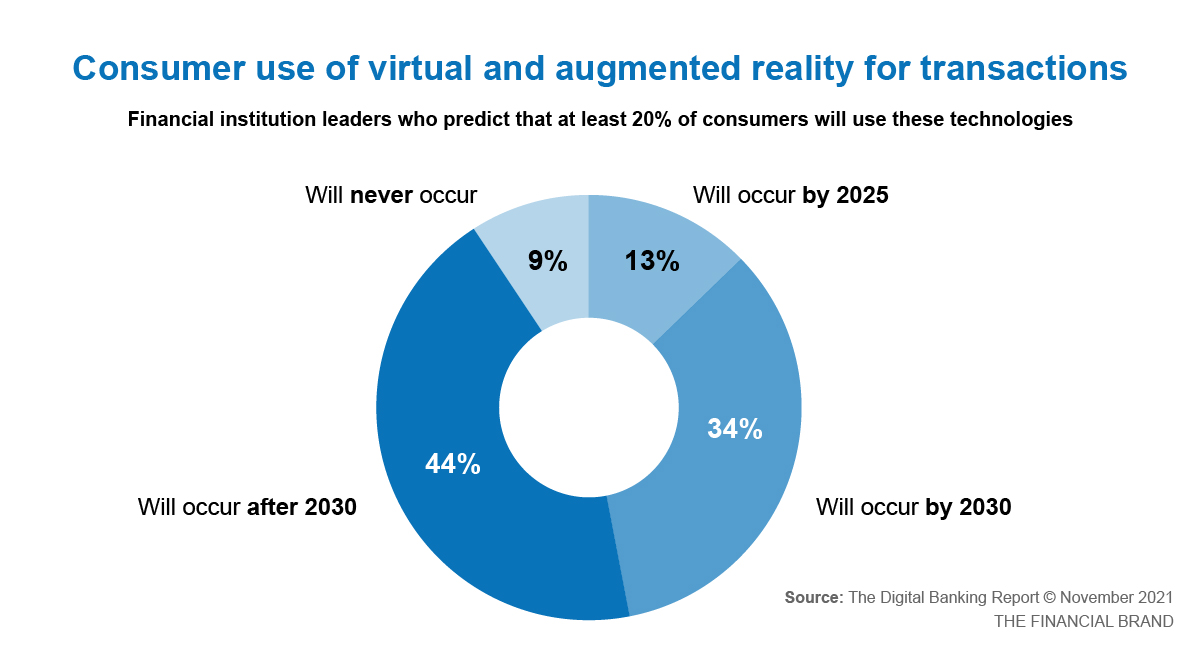

After their success in digital banking, certain banks around the world are now lining up their services for an out-of-this-world consumer experience by embarking on the Metaverse bandwagon. Building new things for the metaverse is suddenly appealing in a way that only comes along once in a while in any business, and financial institutions do not want to be left behind this time. The question is whether the narrative is a response to the immensity of the opportunity, or if it is a little ahead of the reality of enabling technologies.

Banks are already starting to explore virtual reality as a way to improve the customer experience. Barclays has announced its intention to open a VR center in London where customers will be able to try on virtual clothes and buy items for their metaverse avatars. The idea is that in the future you will be able to walk into a store, put on some VR goggles, and see how your purchase would look before making the final decision and paying with whatever currency you choose – including bitcoin or another cryptocurrency. This approach of allowing customers to experience things virtually before they make any real-world commitments may well prove very useful when it comes to selling property too, especially given what we know about people’s tendency towards ‘buyer’s remorse’.

Bank of America has already made big announcements of immersive technology and its potential applications have soared. The bank says that every financial center in its network will use VR headsets to practice a wide range of skills including:

- Strengthening and deepening relationships with clients.

- Navigating difficult conversations.

- Listening and responding with empathy.

The Role of Analytics

Analytics will play a big role in the metaverse. Fintechs and banks need to use analytics to understand how customers are using virtual reality banking services. As simple as identifying skill gaps and giving targeted follow-up coaching and tailored counsel to teammates through real-time analytics to help them enhance their performance. Customer interactions are the most obvious illustration of how the “metaverse” may affect banking. As previously stated, providing clients in virtual environments could be the next logical step in the digital customer experience.

This data can help them improve these services and make sure that they are meeting customer needs. Additionally, analytics can be used to identify new opportunities for virtual reality banking. For example, if a bank sees that many customers are using its virtual reality service to transfer money, it may decide to offer more products and services that cater to this trend. By using analytics, fintech and banks can better serve their customers in the metaverse and continue to stay ahead of the curve in this rapidly evolving industry.

Banking in the metaverse is quickly becoming a reality. For example, CBM Bank in the US is already working on an immersive virtual world experience for its customers – metaverse solutions will be available through augmented reality glasses and even smartwatches. The other bank’s examples include: Members of MetaVRse are collaborating to create a financial ecosystem based on blockchain technology that can also provide innovative solutions such as user-controlled digital identities, registration services, and KYC compliance via crowdsourcing mechanisms. This project has set out to deliver an open metaverse infrastructure platform with increased levels of privacy protection compared to existing public blockchains by using advanced cryptography and AI technologies.

The Learning Opportunity for Banks to Curve Ahead!

It’s widely known that the video games industry is stronger than Hollywood, with revenues exceeding $174 billion in 2020 and projected to reach $314 billion by 2026. (according to Mordor Intelligence).

With approximately 2.69 billion gamers worldwide and about 1.5 billion in Asia Pacific alone, it’s no surprise that Asian banks see an opportunity with a market that is already familiar with digital money.

The curves are to provide a more immersive experience for their customers which can include virtual reality, augmented reality, and even mixed reality solutions. VR banking provides an escape from the traditional banking model that can be mundane and often frustrating. It also offers opportunities to increase customer engagement with new products and services as well as provide a more convenient environment in which to manage finances.

Banks are able to offer differentiated customer experiences through the metaverse while preserving the security of financial data. A recent study found that 43 percent of consumers would be comfortable using virtual reality for banking activities such as checking account balances or making payments. This number is expected to grow as banks adopt VR technology. The trend is already underway, with several global banks launching VR-based customer experiences.

In the metaverse, customers can engage with their banks in a variety of ways. They may visit virtual bank branches, where they can speak to bankers and get advice on financial institutes or products. Alternatively, customers could use VR to view their account balances and transactions or even make payments. For example, HSBC has developed an app that allows customers to pay bills in VR. This immersive experience gives customers a more realistic view of their finances and makes it easier for them to manage their money.

So, where does this lead banks? For me, the most immediate possibility is a learning opportunity rather than a financial one. It’s an opportunity for banks to get ahead of the curve by identifying developments in:

- Digital currency: In the metaverse, digital currency could take on new meaning as users might be able to pay in cryptocurrency or even with their own personal token!

- Digital banking: Imagine being able to deposit money directly into your bank account via virtual reality. In the metaverse, you wouldn’t even have to leave your house to take care of your banking needs.

- Customer experience: In the metaverse, the customer experience is key. Banks that can create a realistic and immersive environment for their customers will be able to provide an unbeatable service. This is where VR really comes into its own – it has the ability to transport users to another world, making them feel as if they are right there in the bank.

- Collaboration: In the metaverse, banks will need to collaborate with fintech in order to provide the best customer experience. The main idea here is that a platform that brings together a variety of various providers is considerably more effective than a single app supplied by a bank for financing alternatives.

Takeaway

The premises seem good for banks that are looking to provide an immersive experience for their customers. VR can offer a unique and captivating space for users, providing them with the opportunity to conduct transactions in a novel environment. Banks will need to collaborate with fintech in order to create this type of metaverse-based service, but the advantages seem clear.

In the metaverse, digital banking will take on a whole new meaning. So are you ready for the new Avatar of Banking in the metaverse?