INTEGRATED BANKING INFRASTRUCTURE SERVICES

Integrated Banking Infrastructure Services

Engineered for Banks

Profinch’s banking infrastructure services offer a future-ready, scalable, and secure backbone for banks and financial institutions, ensuring seamless integration across cloud, database, and middleware environments.

With our expert-driven, SLA-based approach, we deliver highly optimised infrastructure solutions that enhance security, efficiency, and cost-effectiveness, designed specifically to meet the demands of modern banking employees, and customers.

Empowered with specific to banking and financial industry infrastructure needs, we provide precise, pressure-tested solutions that minimise disruption and maximise your Total Cost of Ownership, and ensures that there are no costly surprises for you, in the longer run.

Modernise your banking Infrastructure with our

Premium Infrastructure Services, for Banks worldwide:

The right infrastructure is crucial for banks to innovate, secure, and scale operations, In today’s evolving financial landscape.

Yes, we take care of it all! Just tell us what all you aim to achieve!

We are the only, and exclusive banking Infrastructure Solutions provider to deliver tailored and integrated infrastructure solutions that can seamlessly integrate with your existing legacy banking systems!

USP of Profinch’s Integrated Banking Infrastructure Services:

Streamline your operations, drive digital transformation, and ensure robust performance, whether on-premise or in the cloud.

- End-to-end, Exclusive and the only provider, of specific to banking infrastructure services,

- Decades of expertise with deep domain knowledge in BFSI, globally,

- Security first approach,

- No steep learning curve for your employees,

- No costly surprises for you, in the longer run,

Trusted by top banks across the globe using our services for decades.

Client Reviews

Here’s what our clients have to say about our Banking Infrastructure services

BancABC: “On the infra front, our performance has improved, ensuring high availability and disaster recovery.” — Molefe Petros, CIO, BancABC, Botswana

Our Offerings:

Core Banking Infrastructure Transformation

Future-proof your core systems with scalable, resilient infrastructure tailored to support modernisation and digital growth.

Infrastructure Technology Consulting Services

Receive expert guidance on assessing, optimising, and implementing the most advanced technology solutions specific to your needs.

Database Activity Monitoring – Security

Protect sensitive data with best-in-class security solutions, ensuring your database is safeguarded against breaches and threats.

Cloud Service Consulting

Our cloud solutions—public, private, and hybrid—offer banks the flexibility to innovate without compromising security or performance.

Integration and Automation Infrastructure Monitoring Systems

Seamlessly integrate systems and automate key processes for real-time monitoring, reducing manual interventions and operational risks.

Analytics

Harness the power of data to gain actionable insights, improving decision-making and customer service delivery.

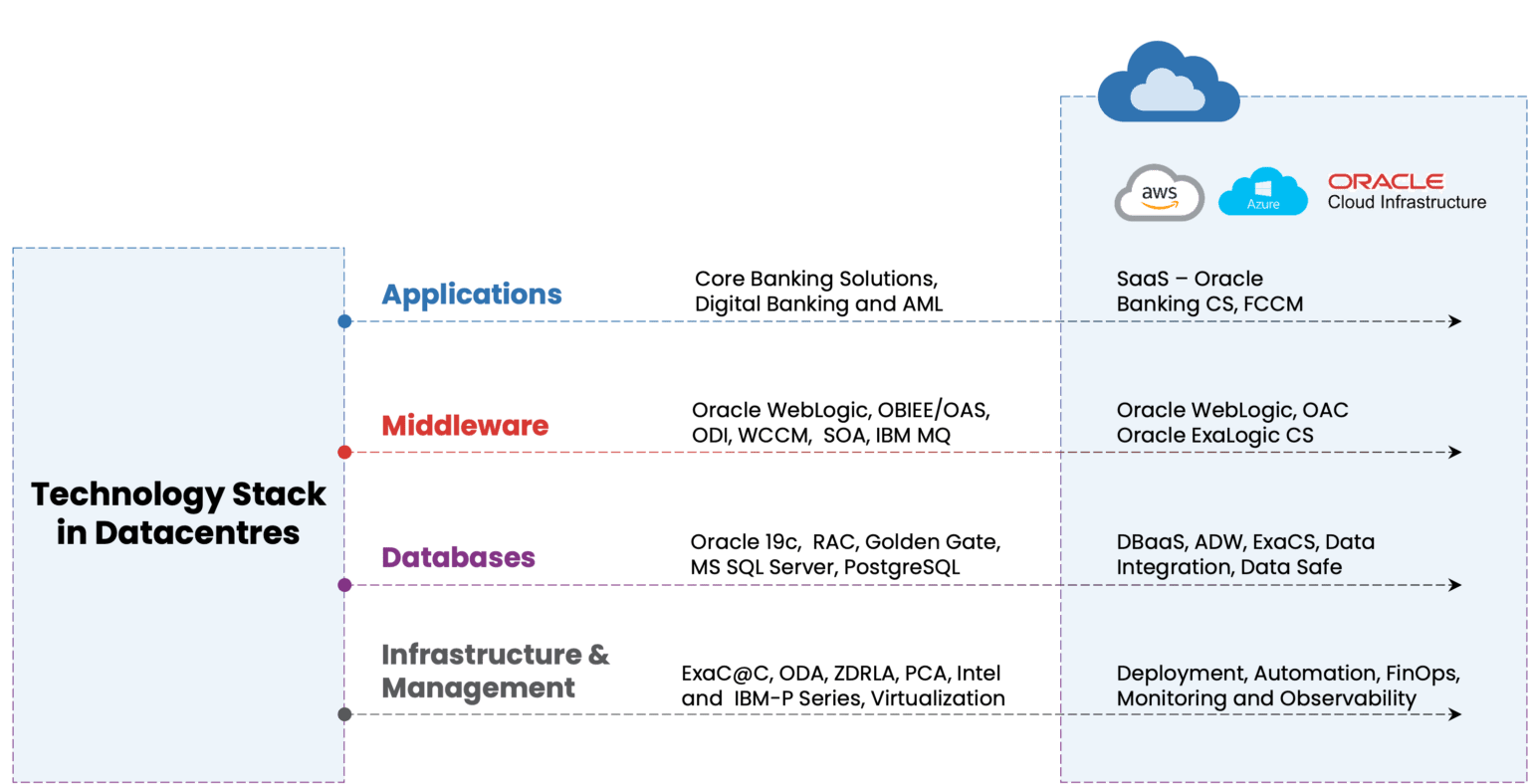

Infrastructure Ecosystem

The Profinch Advantage:

- 80+ Years of Combined Experience

- 30+ Projects, 100+ Disaster Recovery Drills

- Big Data and Cloud Experts

- Comprehensive Knowledge Repository

- Security Across the Spectrum (Database, Middleware, Web-server, Internet)

Start Your Banking Infrastructure Transformation Today

Let Profinch redefine your Banking Infrastructure with cutting-edge solutions built for banks of all sizes.

Contact us:

To learn how we can help you drive operational efficiency, boost security, and scale effortlessly in the competitive environment, just drop us a note, let’s have a chat.

Questionaire

Cloud

Technology licenses are the key for optimizing the spend of IT for both on-prem and Cloud, perform the assessment and understand the utilization along with capacity planning based on the actual growth trend

Optimize existing resources through cloud migration, automation, and performance tuning to increase ROI on technology spend. Additionally, implement data-driven decision-making to ensure investments align with business goals.

To achieve cost optimization need to monitor resource usage with cloud cost management tools and set budget alerts. Regularly review and optimize instances to eliminate underutilized resources and reduce unnecessary expenses.

Yes, conducting regular inventory checks of your infrastructure, including hosting servers, licenses, and cloud services, helps prevent over-provisioning and ensures optimal resource allocation. It also aids in compliance and cost management by identifying unused or redundant assets.

Database

RMAN (Recovery Manager) is Oracle’s utility for managing backup and recovery operations. An RMAN image backup is a full backup of a database, stored in its original format. It ensures that the backup is a complete copy, making recovery faster compared to other methods like incremental backups.

Regular Physical Standby: Directly receives redo logs from the primary database. Cascade Physical Standby: Receives redo logs from an intermediate standby database (which in turn gets them from the primary).

Yes, It can be implemented. In a multitenant environment, you can configure keystores for either the entire container database (CDB) or for individual pluggable databases (PDBs).

- Management and administration

- Performance

ASM disks are block devices that are accessed using direct I/O. This bypasses a lot of moving parts that you will typically find in a cooked file system. Raw/direct disk I/O is faster than doing I/O via a kernel file system driver.

Middleware

By implementing load balancing, resource scaling, and real-time monitoring on the middleware application stack will provide us the control to handle peak transaction loads. Performance tuning and capacity planning need to be regularly revisited to understand the capacity vs demand needs of the system.

Key challenges include legacy system integration, data inconsistency, security, performance mismatches, and scalability issues with modern services.

Maintain failover mechanisms in place for our middleware services. These are tested quarterly as part of our regular disaster recovery drills to ensure high availability and minimize potential downtime.

OS virtualization

Creating multiple isolated instances of an operating system (OS) on a single physical machine. This allows several virtual operating systems to run concurrently, as if they were on separate machines, but they all share the same hardware resources.

Allows multiple OS environments to share a single physical machine, making better use of hardware. Each virtual instance operates in isolation, improving security and reducing conflicts between applications. Makes it easier to scale workloads up or down based on demand.

Exadata

Oracle Exadata is a purpose-built platform optimized for running Oracle Database workloads at peak efficiency. It combines advanced hardware and software to deliver superior scalability, storage optimization, and robust database management for both OLTP (Online Transaction Processing) and OLAP (Online Analytical Processing) applications.

Exadata improves database performance by utilizing intelligent storage, high-speed interconnects, and offloading SQL processing to specialized storage servers. This approach reduces data movement, cuts latency, and boosts throughput. The use of high-bandwidth InfiniBand or RoCE switches ensures fast, low-latency data transmission.

Traditional systems often experience bottlenecks due to separate servers for storage and processing. Exadata integrates both functions, using intelligent storage and ultra-fast interconnects to eliminate delays. This enables faster in-memory processing and significantly improves efficiency.

ODA

Oracle Database Appliance is an integrated, easy-to-deploy solution for running Oracle databases. It combines hardware and software optimized to simplify database deployment, maintenance, and management. It is ideal for banking institutions that require high availability, scalability, and performance for critical data workloads.

ODA offers superior performance due to its integrated hardware and software stack. In the banking sector, where transaction volumes can fluctuate, ODA’s scalability ensures that it can grow with the bank’s requirements, whether it’s handling more accounts, transactions, or customer data. This is crucial for ensuring customer satisfaction during peak times, such as month-end or special financial events.

ODA is designed to be scalable and flexible, making it suitable for banks of all sizes. Small and medium-sized banks can benefit from its simplified management and lower cost of ownership, while large institutions can leverage its scalability and performance for mission-critical operations.

PCA

A Private Cloud Appliance (PCA) is a dedicated hardware and software solution that allows organizations, like banks, to create and manage a cloud infrastructure within their own data centers. This ensures full control over data, improved security, and compliance with regulatory standards.

- Data Sovereignty: Data remains in the bank’s control, ensuring that it stays within the jurisdiction.

- Custom Security: Security measures can be customized for banking compliance, unlike a public cloud where configurations are more standardized.

- Performance: In a PCA, resources are dedicated to the bank alone, providing consistent and reliable performance for critical financial operations.

Yes, PCAs are designed to help banks meet stringent compliance requirements like GDPR, PCI-DSS, and SOX. They provide audit trails, data encryption, and access controls to ensure that banks adhere to legal and regulatory standards.

ZDLR

Oracle ZDLR Backup Server, or Zero Data Loss Recovery Appliance, is an enterprise-grade backup and recovery solution designed specifically for Oracle databases. It ensures that no data is lost during backup operations, providing continuous real-time protection and seamless recovery.

Key benefits include:

- Zero Data Loss: Continuous data protection ensures real-time capture of all database changes.

- Fast Recovery: Reduces Recovery Time Objective (RTO) with near-instantaneous recovery from backup.

- Efficiency: Reduces storage and bandwidth requirements through advanced compression and deduplication.

- Scalability: Easily scalable to accommodate growing data volumes and infrastructure needs.

- End-to-End Protection: Integrated with Oracle Data Guard for full-stack disaster recovery.

License Consolidation

License consolidation is the process of merging multiple licenses (software, hardware, or operational) into a single or fewer licenses. This helps in streamlining license management, reducing costs, and simplifying compliance efforts.

By consolidating licenses, organizations can eliminate duplicate or unused licenses, negotiate better pricing for larger license blocks, and reduce management and renewal overhead.

License management tools such as Flexera, ServiceNow, Snow License Manager, or Ivanti License Optimizer can assist in tracking and consolidating licenses across an organization.

The timeline depends on the number of licenses, vendors, and the complexity of agreements. It can take anywhere from a few weeks to several months.

There’s a potential risk of losing certain benefits, such as legacy support or specific terms. However, working with vendors to ensure key terms are included in the new consolidated agreement can mitigate this.

By having fewer contracts and better visibility, it becomes easier to maintain compliance, avoid audits, and ensure proper usage across the organization.