- The Platform

Lorem ipsum dolor sit amet, consectetur adipiscing elit sed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit sed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit sed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit sed.

Empowering Teller Excellence: Transforming Banking Transactions

Lorem ipsum dolor sit amet, consectetur adipiscing elit sed.

Empowering Teller Excellence: Transforming Banking Transactions

Empowering Teller Excellence: Transforming Banking Transactions

Empowering Teller Excellence: Transforming Banking Transactions

Lorem ipsum dolor sit amet, consectetur adipiscing elit sed.

- Company

- Resources

- Get in Touch

Get BSP Reporting Ready in

Enable ‘Continuous Compliance’ with a ‘Single Platform’ with prebuilt banking capabilities.

‘Prebuilt reports, definitions, data flows, templates, DQ checks, submission formats and many more…

Bring accuracy, traceability, and certainty to your

BSP Regulatory Submissions

The Bangko Sentral ng Pilipinas (BSP) has introduced significant changes to the Financial Reporting Package (FRP) that not only impact the reporting structures and requirements but also mandate banks to move to a more standardized submission mechanism.

Move towards IFRS9 | Risk based CAR (Basel) | OBU Classification

Adapt to IFRS9 standards

The new regime overhauls the standards for classification, measurement and impairment, aligning them with the global IFRS 9 standards and computation of risk-based Capital Adequacy Ratio (CAR) as per the Basel framework.

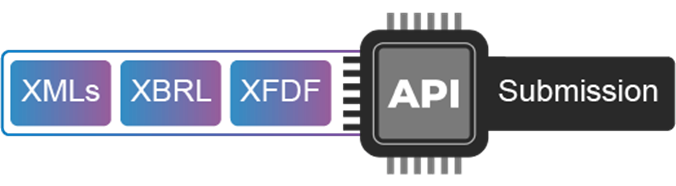

Move away from email-based and FI portal-based submission to API-XML based submission.

The API-XML based submission improves the speed, quality, and security of data transmission and analysis.

Atumverse BSP Regulatory Reporting Platform – Take full control of your regulatory submissions

The Atumverse BSP Regulatory Reporting Platform is part of the Atumverse Central Bank Reporting Suite. It is the most comprehensive regulatory reporting platform that’s built to provide automated, on-time, and error-free submissions.

With Atumverse BSP Regulatory Reporting, we have built an industry leading solution with power packed functionalities

- Prebuilt BSP functionalities: 8 subject areas, 22 catalogue definitions, and over 200 BSP reports

- You can now generate reports in as little as 3 weeks!

- Built ground up with singular focus: Regulatory Reporting

- Software as a Service with minimum capex

- Low code framework driven solution: BSP reports fully manifested with template definitions, element mappings and workflow

- Rule Driven | Data Quality Checks | Business Validations

- Data Lineage | Trace every data point right up to the origin

- Gap Data Upload

- Mart Adjustments (with workflow)

- Audit Trail

- Rules/Logic Repository for easier maintenance

- XML/Excel Report Generation

- Notification Alerts

- Industry Data Mart

- Reports Cross Validation

Benefits of using Atumverse BSP Reg Reporting Platform

- Elevates Bank’s Standing: The core principle behind building the product is to elevate your bank’s standing before the eyes of the regulator, its clients and to help the bank achieve greater status in the country.

- Direct Submission: The Atumverse BSP Regulatory Reporting Prebuilt Product offers direct submission of regulatory reports from the tool to the BSP in every submission format and with real-time status updates.

- Data Lineage: With an internal data lineage from source data to regulatory reporting (and vice versa), the bank has full transparency over the whole data journey.

- Continuous Monitoring: A specialized team of professionals works at Profinch to track, evaluate, and identify BSP regulatory developments. The Atumverse BSP Regulatory Reporting product is continually being updated to reflect the most recent regulatory changes, and the inventory is being examined to meet any arising needs.

- Simplified Data Management: Simplifies the management of data and journeys across the enterprise.

- Fully Automated: Atumverse handles all necessary mappings, automatically producing accurate element values and report outputs.

- Helps Take Control: Atumverse enables banks to create workflows, build related screens and integrate APIs using an intuitive drag-and-drop interface.

- Configurable: Banks can customize and optimize rules, definitions, mappings and workflows to suit their requirements.

- Prebuilt functionalities: Banks get to save on implementation time and costs with prebuilt functionalities and Cloud enablement.

- Makes Regulatory Reporting Simple: Atumverse makes the regulatory reporting process simple with built-in workflow, orchestration, and automation, as well as automated notifications and the retention of previous submissions.

- Intuitive interface: The product enables business users to make modifications through an intuitive interface prior to submission and includes a full audit trail, maker-checker controls, and historical tracking.

- Validation Rules: Atumverse has inbuilt regulatory validation rules both for inter and intra reports, ensuring data consistency and accuracy. The product allows business users to add custom validations easily and seamlessly.

- Data Quality: Data quality checks at every stage of data journey.

- Dashboards: Reports and Compliance Dashboard to keep a tab on submissions and progress through pipelines.

- Adjustments: Report Adjustments to make changes anytime during the submission journey.

- Scheduler: Reports scheduler to automate submissions.

- Continuous Releases: Releases with latest versions as per BSP updates. Available on Cloud.

- IAM: Robust IAM linked to user role/seniority.

- Industry Data Marts: Create reports through industry/country marts already available with the solution.

View all BSP FRP reports.

Blog Alert !

12 Common Mistakes to Avoid While Preparing and Filing BSP FRP Reports in the Philippines

FAQ's

BSP Regulatory Reporting requirements include reporting on credit risk, market risk, operational risk, liquidity risk, and other relevant information. Philippine banks and fintech companies must comply with the reporting requirements outlined by the Bangko Sentral ng Pilipinas (BSP), which is the central bank of the Philippines.

Non-compliance with BSP Central Bank Reporting regulations in the Philippines can result in fines, penalties, and even the revocation of a bank or fintech company's license. The BSP takes regulatory compliance very seriously, and failure to comply with reporting requirements can have serious consequences.

Philippine banks are required to submit their BSP Regulatory Reporting regularly, typically on a monthly or quarterly basis depending on the type of report. However, some reports may be required more frequently, such as daily reports for liquidity risk management.

The BSP Regulatory Reporting system plays a critical role in the Philippine banking and fintech industry by promoting transparency, accountability, and stability in the financial system. The reporting requirements provide the BSP with important information to monitor and manage risk in the financial system.

Common challenges include the complexity of the reporting requirements, data quality and accuracy, and the need to ensure compliance with changing regulatory requirements.

Best practices include leveraging technology and automation to streamline the reporting process, conducting regular data quality checks, and ensuring compliance with regulatory requirements through ongoing monitoring and reporting.

Technology and automation can help simplify the BSP Regulatory Reporting process by reducing manual processes, improving data accuracy and quality, and enabling real-time reporting. Automated reporting systems can help banks and fintech companies improve their compliance with regulatory requirements while reducing the risk of errors.

The most important data points include data on credit risk, market risk, operational risk, and liquidity risk. Specific data points will vary depending on the type of report and the requirements of the BSP.

Philippine banks and fintech companies should stay up-to-date with ongoing initiatives and updates related to BSP Regulatory Reporting, such as changes to reporting requirements or new reporting standards. Staying informed about regulatory changes can help banks and fintech companies ensure compliance and optimize their reporting processes.

Philippine banks and fintech companies can ensure the accuracy and completeness of their BSP Regulatory Reporting data by conducting regular data quality checks, implementing automated reporting systems, and maintaining compliance with regulatory requirements. It is important to establish clear processes and procedures for reporting.