Integrated Data and Digital Cloud Ready Platform

What is Atumverse?

The World’s First ‘Single Platform’ to build Data, Regulatory, Digital Applications and Workflows on an IDE

What does Atumverse address?

Transform with Digital

- Faster time to market of BFSI product roll-outs through digitization

- Seamless experiences across staff, customers, and agents

- Transformational capabilities across front, mid and up to back-office

Lead with

Data

- Achieve better outcomes with data

- Achieve regulatory compliance

- Leverage Big Data and Analytics across businesses and ecosystems

Drive Efficiencies

- Through our unmatched BFSI domain expertise

- Improve experience, innovation

- Reduce overall TCOs by embracing digitization and cloud

- Automation leading to reduced TAT

Atumverse Digital Platform - Out-of-Box Applications

- Integration with Credit Bureaus

- Aids in cross-selling and up-selling

- Time is tracked for each stage of the process, which aids in streamlining.

- Customer data and docs on a single screen, giving the choice to transact

- Monitor the lead-to-customer conversion ratio.

- Transact offline

- Configurable Single Platform

- Notification Reminders for Various Processes

- Automated Rule-based Assigning Of Tasks

- Role-Based Dashboards List Transactions To Act On

- Automated Flow Of Data Across Departments

- Questionnaires for Customer Ratings

- Role-based Data Access

- integration with multiple external bureaus.

- Automated Reports

- End-to-end Automation

- Enhanced UX for ease of transactions

- Allows multiple transactions for a single customer

- Transactions Data Available On The Same Screen

- Authorization Based On Digital Signatures Or Biometrics

- Add Customer Restrictions Of Various Types

- Assign Transactions To Treasury For Preferential Exchange Rates

- Uploaded Transaction Docs Available For Full Transaction Life Cycle

- Multiple Products And Payment Facilities Through A Single Agent

- Comprehensive Security And Risk Management Framework

- Robust Payment Monitoring

- Pickup Charges From Core Systems

- Define Rules To Check Risks

- Configure Flexible Transaction Limits

- Multiple Transactions For A Single Customer

- Multi-currency Transactions From A Single Screen

- Transactions Data Available On The Same Screen

- Robust Till And Vault Framework

- Authorization By Digital Signatures Or Biometrics

- Wallet sign up and registration along with QR code creation

- Wallet to wallet / Contact transfer

- Wallet to Account transfer

- Utility payments and mobile recharge through wallet

- Wallet Passbook, Transaction reports

- Scan QR code to pay

- Loan repayment from wallet

- Onboard Customers Anytime, Anywhere

- On-the-go-offline Advantage

- DMS Makes Docs Secure And Available

- Multiple Products And Payment Facilities Through A Single Agent

- Flexible Integrations With Partner Systems

- Powerful Auditing With Geo Location

- Flexible Reporting And Reconciliation Frameworks

- Simplified onboarding and claims using bots, digital / audio / video KYC

- Workflow Automation for UW, claims, and admin functions

- Document & Letter generation

- Customer 360 : Help Center, Demographics, lifestyle, spend, other products

- Omnichannel Access to information

- Coverage across Health, Life, Motor, P&C Insurance, Fire Insurance, Travel Insurance

- H2H payments

- Trade Finance Workflows

- Treasury Automations

- Customer Statements

- Branch Settlements and many more…

- Identify, process, and track delinquent customers

- Analyze and view customer metrics

- Execute collections strategies according to customer data

- Automate collections management process

- Schedule and follow up using digital methods

- Retain records of customer payments

- Review a customer's demographic and age data

- Automated allocation process

- Attach notes to a customer's records

- Use notifications / reminders / tags for better tracking

- Collection agent and KPI tracking

- Integrated online appointment scheduling offering “Zero Wait” time for privileged customers

- Virtual token activation on arrival

- Intelligent routing of customers based on tasks and bank staff availability

- Customer prioritization based on customer value

- Automated Data capture and distribution through pre-integrated DMS

- Enhanced UX for ease of transactions

- Define UW rules specific to products

- Configure medical test sets, define medical / financial grids, authority limits for users

- Create reflexive questionnaires

- Built in Maker – Checker logic

- On-Premise and Cloud deployments

- Upload and retrieve documents related to proposals

- Role based access control

- UI to configure workflows and stages

- REST and SOAP enabled Integration engine to interact with systems

- Analytics module for insights on past performance, refining rules

- Audit trail of all transactions

- Detailed, configurable, user-friendly UW dashboards

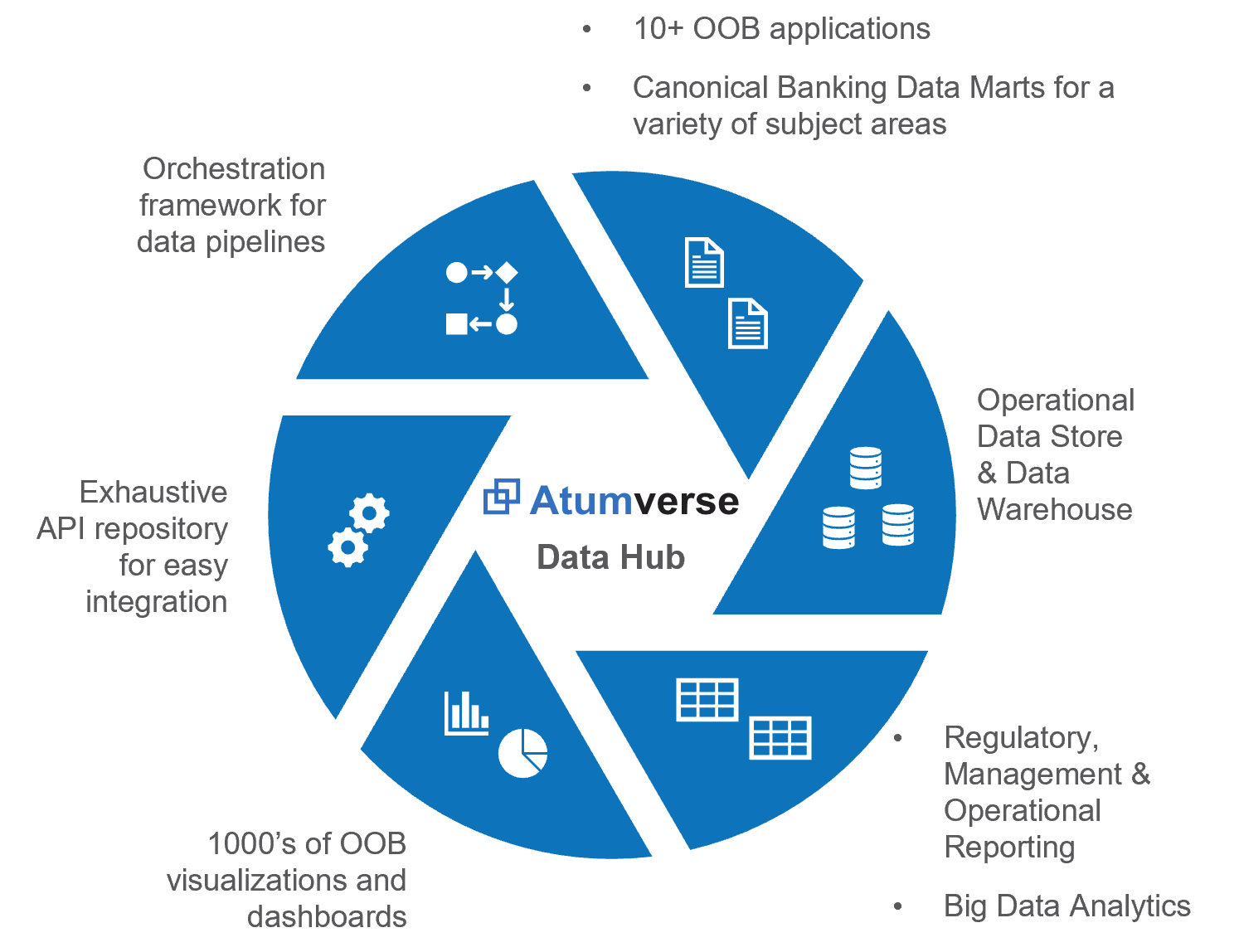

Atumverse Data Platform - Out-of-Box Applications

- Single source of truth for internal purposes

- Coverage across Retail, Corporate, Islamic Banking, Sales

- Thousands of OOB KPIs, metrics, dashboards and operational reports

- Industry standard banking data mart across 20+ areas - like Loans, Deposits, Treasury, Trade, Securities etc.

- Prebuilt banking data lake

- Data fabric and catalogue

- Statistical Modelling

- Ready to deploy solution

- Easy to maintain reports

- Easy to manage changes

- Easy integration with other systems

- Self Service and drill downs

- Pre integrated adapters

- Robust ELT process and scheduler with alerts

- Maker checker and audit trail for adjustments

- Backward traceability

- Reconciliation and validations built in

- Regulatory reporting for 10+ Countries

BSP's Regulatory Reporting Solution

BSP’s evolving regulatory changes demands banks to adopt innovative and adaptable solutions. Simplify management of data and transaction journeys for efficient BSP Reporting using Atumverse…

Features

Digital Platform that orchestrates seamless digital journeys across user groups and channels

- Intuitive Omni-channel experience

- Built-in workflow tool and onboarding data framework

- Pre-integrated DMS

- Microservices-web applications with drag and drop IDE

- Isolated to microservice only catering to that business function

- Automated notifications

- Commission engine and reporting

- Component based technology

- Configurable platform

- Core agnostic

Data Platform for Reporting

and Analytics

- Layered architecture – with extensibility to add applications on marts

- Financial reconciliation with adjustments workflow

- Regulatory ready with configurable frameworks

- Built-in data migration, scheduler, archival

- Advanced visualizations

- Ensures data traceability

- Consistency checkers

- Core agnostic

Components

APIs & Microservices

Drag & Drop IDE

Knowledge Portal

Unified Code base

Realtime Notifications

Configurable Frameworks

Data Models

Ready Templates

IAM

Data Quality & Traceability

Recon & Adjustments

Prebuilt Integrations –

Internal & External

Centralized Configurations

What makes Atumverse unique?

Low Code

Integrated

Platform Agnostic

Cloud Ready

Institutionalizing Value Acceleration Across FIs and Domains

Corporate and Global Transaction Banking

Islamic Banking

Commercial Banking

Digital and Neo Banking

Microfinance and NBFC

Mergers, Consolidation and Multi-country rollout

Digitization, Customer and Back office

Fraud Management

Financial Crime and Compliance

Central Banks

Connect with us to understand how we can add value to your business.

Proud to be recognized

as a global leader

Atumverse Digital & Data Case Studies

(non-exhaustive list)

What Our Customers Say

Samit Kumar Bhatnagar

Chief Information Officer, TISA

Mohamed Abdel Hamid Abdel-Razek

Group Head of Technology, Transformation, and Information at Mashreq

Bakhrom Numonov

Chairman of the Board of Apex Bank, Uzbekistan

We have been elated by this partnership with Profinch, the team has been very professional and diligent in their efforts to ensure a smooth and timely go-live. With Profinch’s expertise and our commitment to excellence, we are confident in establishing Apex Bank as an innovative and credible financial institution in the country in Uzbekistan.

Molefe Petros

CIO, BancABC, Botswana

On the infra front, our performance has improved, ensuring high availability and disaster recovery.

AMHA Tadesse

VP - IT, Zemen Bank, Ethiopia

Extremely competent, forthcoming and professional. Turn around projects as per timelines and have the right blend of skills.

Bahlul Lawela

ICT Advisor at CEO Office, National Commercial Bank, Libya

We appreciate all the professional recommendations that help us to secure the system. Looking forward to working with you in other future projects as NCB management is willing to engage Profinch in future IT strategic projects.

Adisa-Adediwin Olufunsho

Head of IT Solutions and Innovations, LAPO Microfinance Bank, Nigeria

The infrastructure team of Profinch is truly a reliable partner in providing technical solutions to system configurations, database planning, creation, and migration. This was further proven by the astute and timely delivery of our core banking database migration. The team's expertise and professionalism were top-notch with best practices.

Dilshod Narzulloev

CEO, Tamvil Finance, Tajikistan

Rate them highly on service delivery, functional and technical know-how. Well informed, managed the entire project well. Process frameworks and tools ensured smooth implementation.

Lutfi Al Shukaili

Head of Customer Experience - Alizz Islamic Bank, Oman

Atumverse has helped us become more efficient. Importantly, the users have found Atumverse easy to use and has helped them have better control over processes.

Bhkhtovar Yusufi

Deputy CIO, Orienbank, Tajikistan

We decided on Profinch and haven’t looked back. Team is enthusiastic, innovative and determined to support.

Khisrow Fazli

COO, Ghazanfar Bank, Afghanistan

We wanted a partner with rich experience in implementation and delivery. We onboarded Profinch and continue to engage on multiple projects, including using their data platform, Atumverse.

Hameed Mohammed

Assistant Vice President IT, Mawarid Finance PJSC, UAE

Atumverse has changed our Business Intelligence & Reporting landscape. One of the most robust and user-friendly data platforms in the market.

Vidyasagar Bedida

VP, Technology and Processes, Jana Small Finance Bank, India

Smoothly managed the entire project. Extremely committed. Met deadlines.

Charles Crabbe

Head of Operations, GCB Bank Ltd

Liked the process-oriented approach. Well prepared during all project stages. Helped us meet timelines.

Management

Bankmed

We have been working closely with Profinch team on a new Core Banking System for reporting, reconciliation and data requirements. They have been prompt and thorough in understanding our requirements and have been consistently delivering needed work tactfully and in a timely manner.

Management

ABSA Bank, South Africa

Our relationship since 2019 has strengthened so much and we trust the company because of its great expertise. We are extremely impressed with Profinch’s deliveries to help us get stronger during our journey.

Management

CTO, COO, IT, FBN Bank, UK

We have very much enjoyed working with the team and really appreciate guidance, hard work and the approach to this first project and look forward to continuing this in our future collaborations.

Management

Al-Andalus Bank

We have been working closely with the Profinch team on implementation of FCUBS 14.3 and OBDX 19.1 on Oracle Cloud Infrastructure. The Profinch team stands out when it comes to the in-house expertise, and is spot on in terms of support. Their capabilities in understanding our requirements are commendable and their addressal ensured a seamless delivery of an imperative solution.