APRA Overview: Understanding the Australian Prudential Regulation Authority

What is APRA, and what is their role in the financial sector?

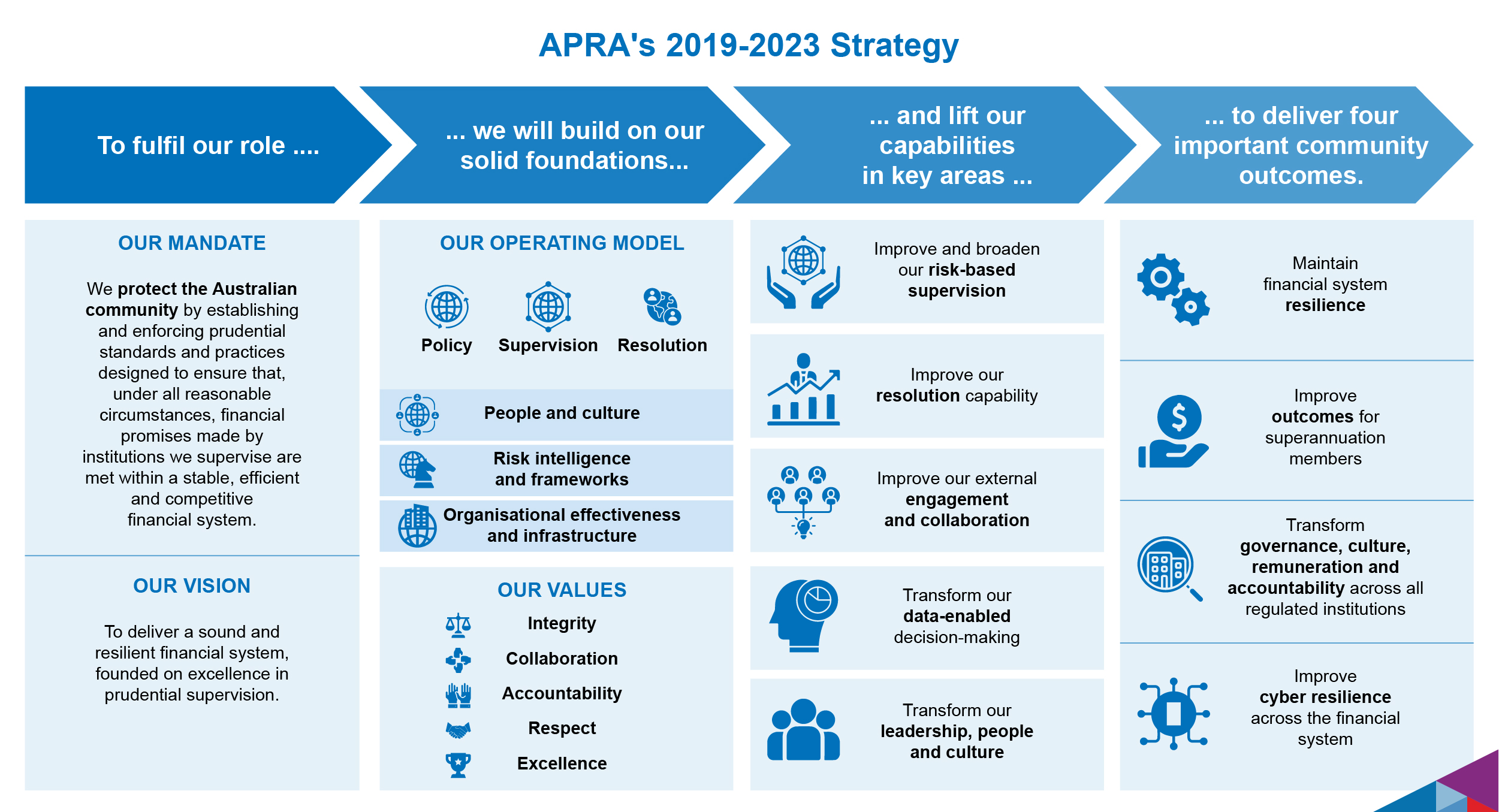

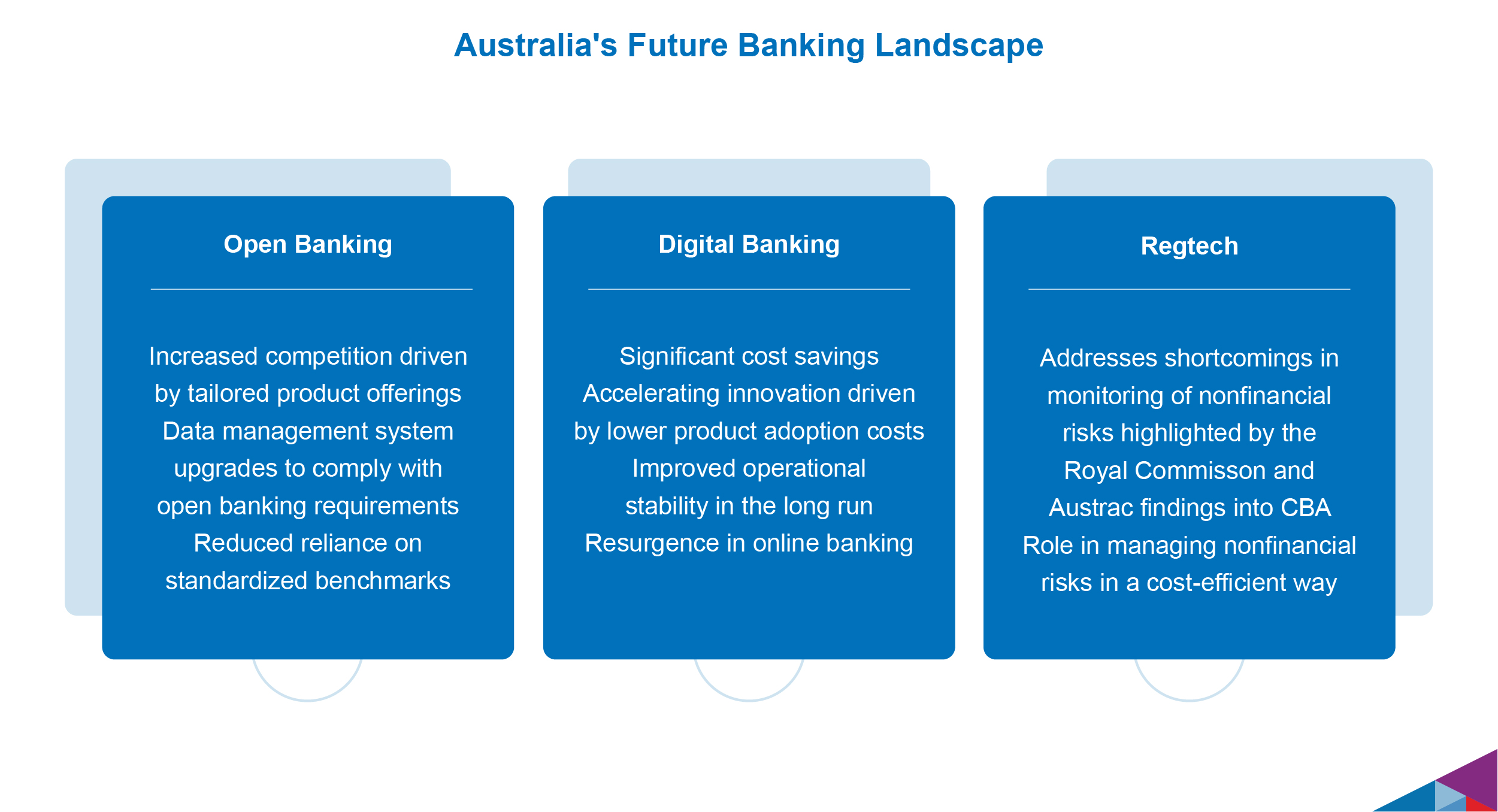

APRA’s role has evolved in response to Australia’s financial sector and overall economic environment changes. For example, following the global financial crisis (GFC), APRA increased its focus on systemically important institutions and introduced more stringent capital adequacy requirements. In recent years, APRA has similarly responded to developments in the fintech sector, introducing a tailored licensing regime for ‘Authorised Deposit-taking Institutions (ADIs) that offer banking services through digital channels.

How do they regulate the banking and insurance industries?

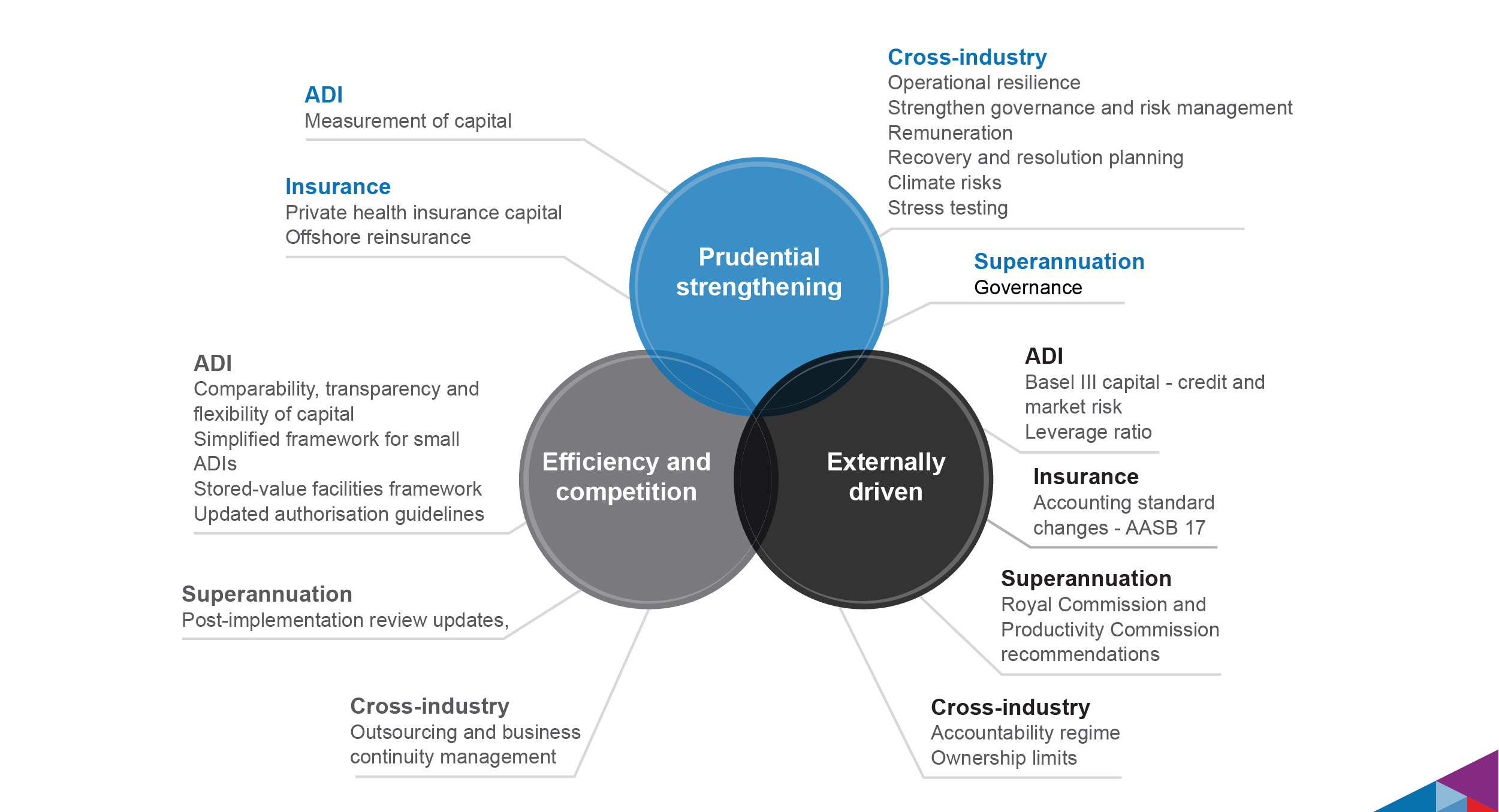

APRA regulates the banking and insurance industries by setting and enforcing prudential standards. These are rules that financial sector entities must meet to protect the interests of depositors, policyholders and other creditors. Prudential standards relate to capital adequacy, liquidity, risk management, remuneration and governance.

APRA defines prudential criteria that regulated institutions must follow. These guidelines specify the number of requirements regarding financial stability, risk management, and governance as all essential factors.

APRA also monitors compliance with prudential standards through on-site examinations and off-site surveillance. Financial sector entities must provide regular reports, detailing their compliance with the relevant standards. In addition to regulating banks and insurers, the Australian Prudential Regulation Authority also has a role in supervising the superannuation industry. This includes licensing superannuation providers, monitoring their financial soundness, and protecting members’ retirement savings.

What impact has fintech had on APRA’s work?

Discussions have covered that fintech has been taking place at APRA for several years, and has released a number of papers on the topic.

In March 2016, APRA issued an information paper on ‘Regulating Fintech ‘, which sets out current thinking on applying prudential regulation to fintech businesses.

APRA is currently working on a regulatory sandbox, which will provide a framework for testing innovative products and services in a live environment while ensuring that appropriate consumer protection safeguards are in place. The sandbox is expected to be launched later this year.

The increasing use of technology by financial sector entities has led to new risks and vulnerabilities that need to be managed by APRA. For example, cyber management practices and controls need to be strengthened in light of the increasing number of cyber-attacks on financial sector entities.

Australian Prudential Regulation Authority also monitors the development of new financial products and services, such as peer-to-peer (P-to-P) lending and crowdfunding, to ensure that they are being prudently offered to consumers.

What are some benefits of APRA’s work?

APRA’s work benefits the overall financial system by promoting stability and efficiency. By regulating entities in the financial sector, the new regulatory reporting structure helps ensure that these institutions can meet their obligations and continue to function smoothly even during times of stress. Additionally, APRA’s efforts help protect consumers and promote competition in the financial market. Through its supervision of banks, insurers, and other regulated firms, the authority can identify risks early on and take action to mitigate them before they become a problem.

This helps keep Australia’s economy strong and protects taxpayers from having to bail out failed financial institutions. APRA safeguards the Australian community from financial loss and financial system disruption by planning and implementing the rapid resolution.

How has the financial sector grown with the help of APRA?

The Australian Prudential Regulation Authority has been a key regulator in the country’s financial sector growth. By collecting data from entities within the sector and reporting on regulatory authority of australia requirements, APRA has helped create an environment conducive to growth.

In addition, as technology has evolved, the Australian Prudential Regulation Authority has worked with fintech companies to ensure that they are compliant with regulations and can continue to grow in this rapidly-changing industry. Thanks to the work of APRA, the Australian financial sector is one of the most robust in the world.

Are there any challenges that APRA faces currently or in the future?

APRA has been very successful in its work to date, but regulators always face challenges. In the future, APRA will need to continue to monitor and regulate the financial sector while also working with fintech companies to ensure that they comply with regulations.

Additionally, as technology evolves, the Australian Prudential Regulation Authority may need to adapt its regulatory framework to account for new risks and technologies. However, given APRA’s history of success, it is well-equipped to handle any challenges that come its way.

APRA regulatory reporting solution

Profinch actively works with Banks and FIs in Australia. Profinch’s FinCluez is a one stop solution for banks and FIs to be APRA-EFS regulatory compliant in Australia.

To learn more or for any queries, please contact us by filling out the form below, and we will get back to you as soon as possible.