The Evolution Of Digital Banking: From An Exaggerated Utility To A Necessity

Introduction

The digital banking industry has come a long way since Charles Schwab opened the first online brokerage account in 1975. From an exaggerated utility to a necessity, digital banking is now one of the most popular financial services available today. What started as simple online transactions and bill pay has evolved into digital-only banks that offer more than just checking accounts – they provide loans, mortgages, credit cards, insurance coverage and more. This also means that banks will no longer be restricted to opening hours but will also offer the ability to carry out certain transactions from anywhere at any time.

Technology has been a driving force behind the growth of digital banking. It allowed for the development of innovative features and products that have made digital banking more convenient, accessible and affordable for consumers worldwide. For example, mobile banking allows customers to conduct transactions from anywhere using their smartphones and other mobile devices. This was also beneficial during the pandemic as it allowed people to continue operating their financial affairs even if they were self-isolating or quarantined.

This article will take you through digital banking’s evolution over the last 40 years, exploring how technology impacts digital banking today!

Digital banking and its evolution

Growth of digital banking

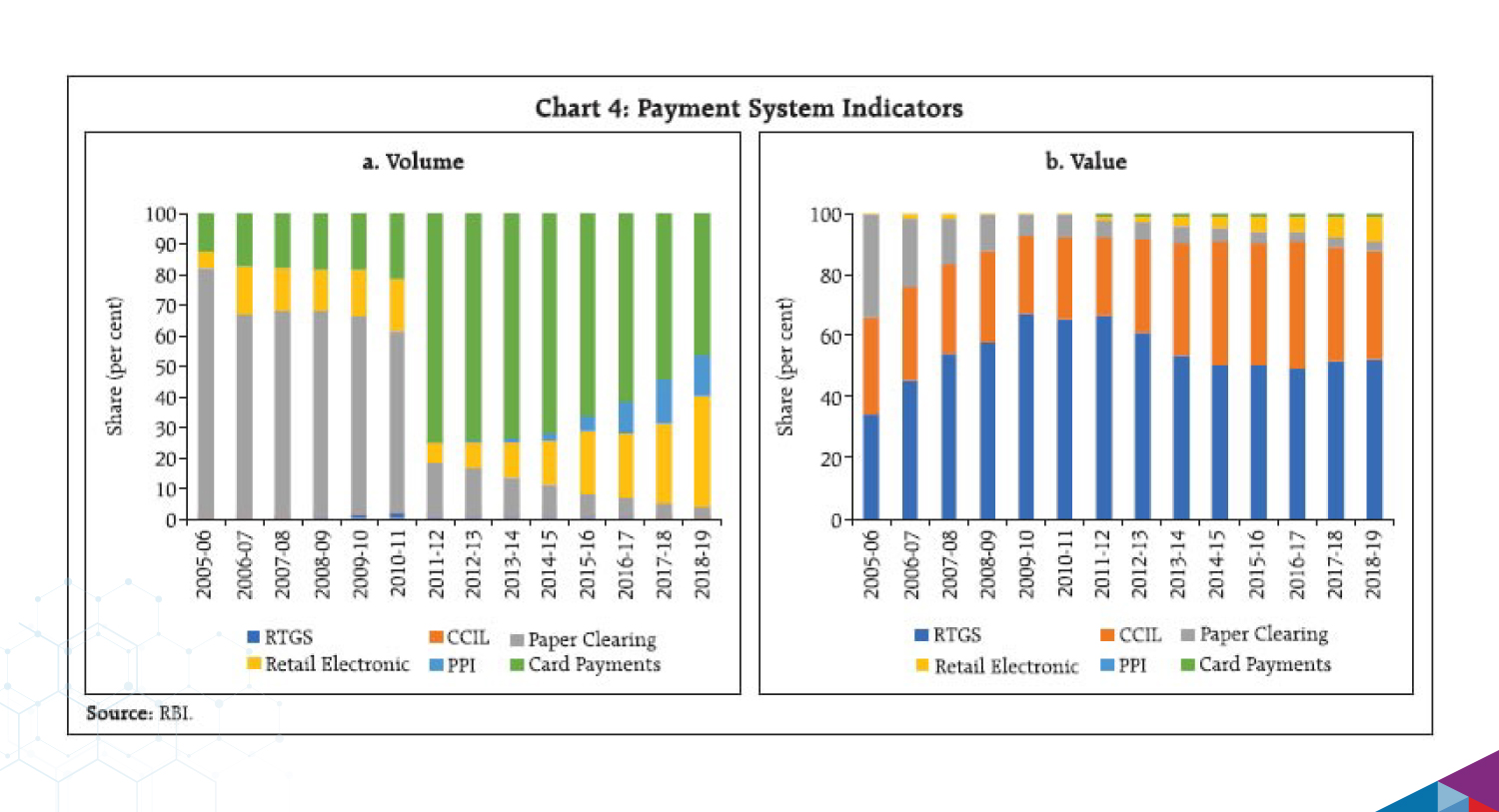

The path to digital banking is irreversible, and there are key factors in this development. Technology plays a huge part in digital banking, especially digital payments. The latest Development Edition of World Payments Report by Capgemini analyzes digital payment trends for 2021 and reports that by 2025, instant payments and e-money payments will account for more than 25% of global non-cash transactions, up from 14.5% in 2020.

Advantages of digital banking

- Digital banking is 24/seven accessible; customers can bank anytime and anywhere.

- Digital solutions such as mobile apps offer a self-service option since the customer handles their needs through an app on their phone instead of having to talk with someone who takes care of business for them.

- Digital payments and mobile wallets have become more the norm than the exception.

- Transactions are processed quickly.

- Digital banking was of great help during pandemics as customers could access their account from anywhere without having to go into a physical bank branch.

- Surpassed the number of people visiting bank branches.

Role of digital banking during the pandemic

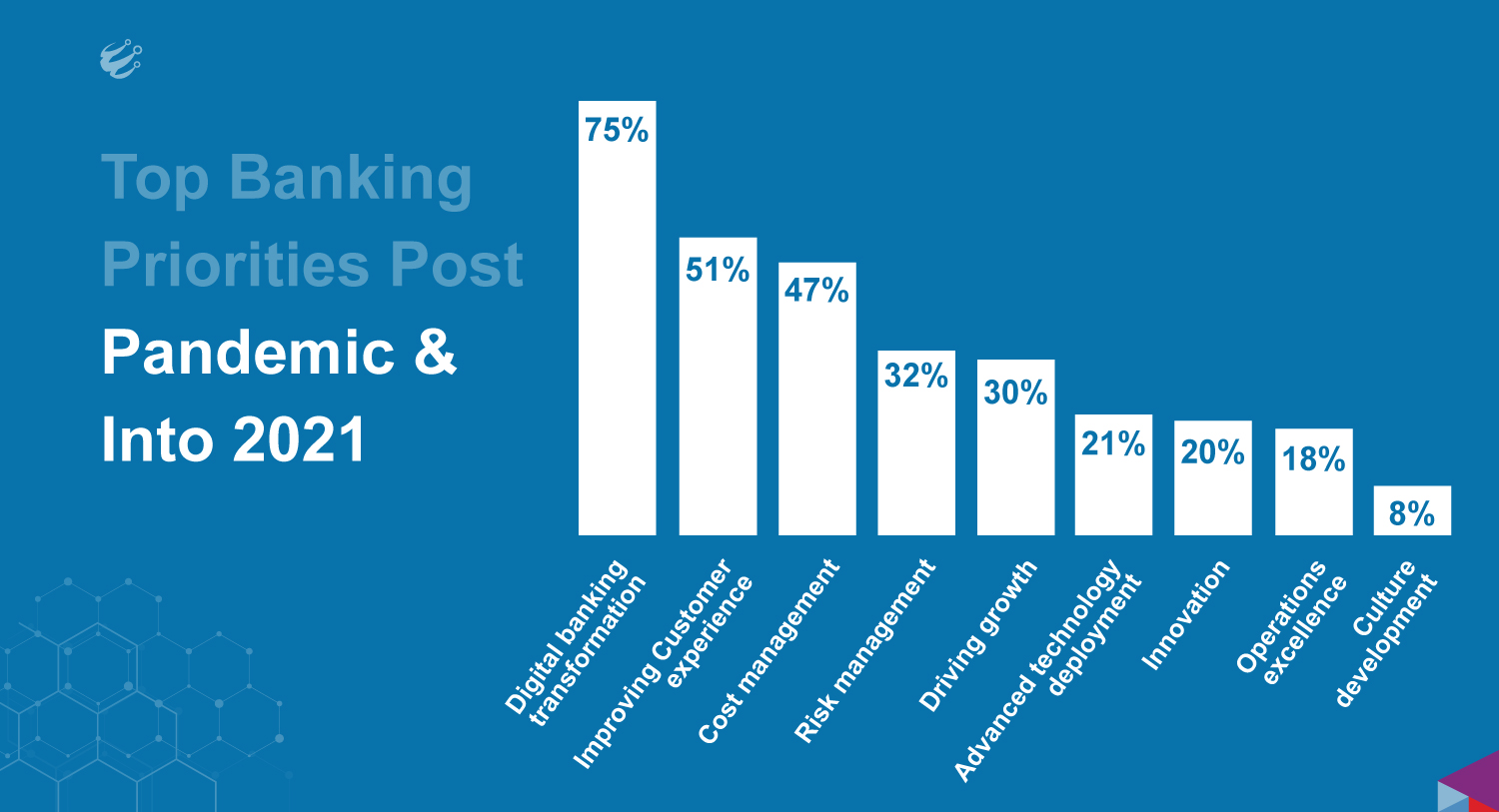

The HINI Flu Pandemic in 2009 was one instance when digital channels helped to ease the stress of many people and especially during the COVID-19 pandemic, the role of digital banking changed permanently. Banks adapted the business model to ease operations and gave a better online banking experience to their customers. The COVID-19 pandemic has forced banks to rethink the customer experience from another perspective. According to the study, the isolation caused by confinement during COVID-19 has stimulated the adoption of digital channels by this audience, incorporating them into the world of banking digitization and online commerce.