Impact of AI in Banking: Opportunities and Challenges

In spite of billions of dollars being devoted to digital transformation in banking technology each year, few banks have supervened in diffusing and scaling AI technologies throughout the institution. The prevailing models of IT and legacy technologies are beset by reasons including a lack of an integrated AI strategy, disconnected data assets and hampered collaboration between the business, customer and technology teams. Supplementary to that, the COVID-19 pandemic has accelerated digital engagement, caused tectonic shifts in customer behaviour and soaring expectations. To drive new value propositions and distinguishing customer experiences, incumbent banks are becoming AI-first and AI-driven organizations.

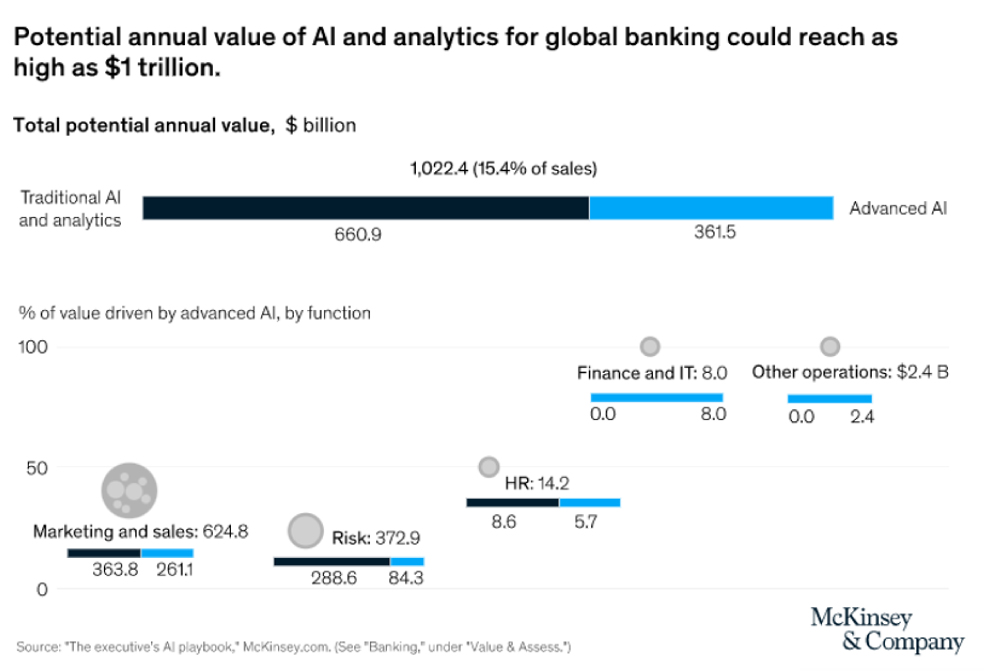

According to McKinsey, AI has the potential to unlock the incremental value of $1 trillion for banks, annually. Artificial intelligence technologies are integral to our world today. They are known as one of the largest value creators across industries.

As per the Global Opportunity Analysis and Industry Forecast by Research Dive, the estimated global digital market size for 2020 was USD 947.3 million. However, the real-time figure is USD 972.2 million. COVID-19 outbreak impeded banking operations across the world and drove non-tech-savvy customers to cut back on branch visits and embrace digital banking. As more customers adopt digital banking, they expect banks to evolve and deliver seamless experiences. Incorporating artificial intelligence (AI) into banking operations will significantly accelerate the digitization process.

AI Catalyzes the Digital Banking Landscape

Banks are leveraging the benefits of AI for holistic transformation spanning several layers, including operations, customer support, marketing, risk management, and compliance. AI has the potential to transform traditional processes into scalable, flexible, and future-agnostic functions. AI-first banks are offering propositions and customer experiences that are intelligent, personalized, timely and relevant. It is enabling a consistent experience based on a detailed understanding of the customer’s past behaviour to offer relevant services and products beyond only banking.

Industry leaders are bringing in groundbreaking technology such as cognitive RPA, interactive voice response, pattern recognition, AI-based self-service applications, smart chatbots, biometric fraud detectors, and data mining tools to improve backend processes and personalize customer support. These algorithmic solutions boost revenue generation and promote cost reduction while reaching beyond human accuracy and productivity levels.

How will the AI-first Banks of the Future Look?

The implementation of AI in banking is largely demand-driven and customer-oriented. Accenture compiled a survey of banking customers and their ever-evolving needs to find that 71% of the respondents would prefer computer-generated customer support. While 78% of the respondents would use automated support for investments. The next frontier of AI-first institutions is poised to include:

Asset Management: AI-based advisors can be implemented to generate advice based on world events. They have the potential to forecast the impacts of such events on asset prices and are useful for risk modelling.

Credit Scoring: AI-based credit scoring offers a nuanced evaluation of data to expedite accurate decisions. AI tools use techniques like machine learning (ML) and ensemble learning to analyze data for predicting scores with the ease of scalability and reevaluation.

Fraud Detection: Advanced pattern-matching analytics helps bank systems detect fraudulent activity and is an essential element in designing a preeminent anti-money-laundering process. Adopting ML passes all transactions through a legitimate screening process while saving costs and reducing the chances of unscrupulous proceedings.

Market Research: AI-driven intelligent agents use NLP to curate and semantically index research content. They assist bankers with strategic trade information and trends by analyzing keywords within websites, research reports, and news from the financial markets.

Customer Support: AI assistants and chatbots use cognitive ML to identify context and emotions during customer support chats. Natural language processing (NLP) allows them to revert to customer queries instantly and offer personalized financial advice. Self-help customer service enhances digitized customer experience while saving costs for banks.

How does AI Reimagine Customer Expectations in the Banking Industry?

In an attempt to meet customers’ rising expectations, banks are evolving themselves to compete in an AI-powered digital era. The spotlight is on offering intelligent, personalized, and omnichannel products and services. Research forecasts growth in the implementation of AI in the banking industry, with a projected revenue of around USD99 billion in the Asia Pacific region alone.

Building digital solutions such as AI capabilities adds the following value to a bank’s business model:

- Improve customer relationships

- Reduced costs

- Boosts productivity

- Better insights

- Accurate analytics

- Reduced risk

- 24/7 service

- Meticulous marketing

- Enhanced operational efficiency

- Predictive forecast

- Cybercrime mitigation

Leaping the Hurdles that Accompany Implementation of AI in Banking

Although AI is a promising technology, the magnitude of change required to implement it is herculean. The significant challenges with implementing AI in banking, to reset post COVID-19 are:

Data Quality: AI is a data-driven technology, as data quality affects the prediction power of an algorithm. Lack of adequate and credible data encumbers its appropriate processing and that calls for perspicacious data management using advanced analytics and end-to-end AI modelling.

Black Box Effect: The complexity of neural networks makes machine learning challenging to decipher. Not everyone across teams can easily understand and comprehend the modelling logic. To ensure regulatory compliance, banks must increase governance. Adopting visual interpretation and model management frameworks will help bank management leverage the benefits of explainable AI.

Narrow Focus: AI algorithms can efficiently solve specific problems but cannot address contextual issues. Incorporating emotional intelligence will help train the system to perform beyond rationale.

Adoption of AI Technologies – A Strategic Imperative for Banks

The ongoing crisis has steered traditional banks to recognize the need to implement AI advancements in their vision, planning and how they engage with their customers. They are striving to deliver intelligent services and personalized customer journeys at breakneck speed. To realize and fulfil this vision requires a robust and progressive technology stack. At all times during this undertaking, banks must stay attuned to customer perspectives and how the AI bank can create personalized value for each customer.