CBDC - A Comprehensive Guide to Central Bank Digital Currencies

Recently e-Naira, the Central Bank Digital Currency (CBDC) was launched in Nigeria amidst much fanfare. Nigeria is the latest country to join a bandwagon of countries like Bahamas, Sweden and China. A recent survey reveals that almost 85% of central banks are in various stages of rolling out their own CBDC. Some banks are in conceptualisation stage while some banks are building the product while others are getting ready for a pilot rollout. Almost every day, we see dozens of blogs being published on CBDC. But what is the CBDC hype all about?

What is a CBDC?

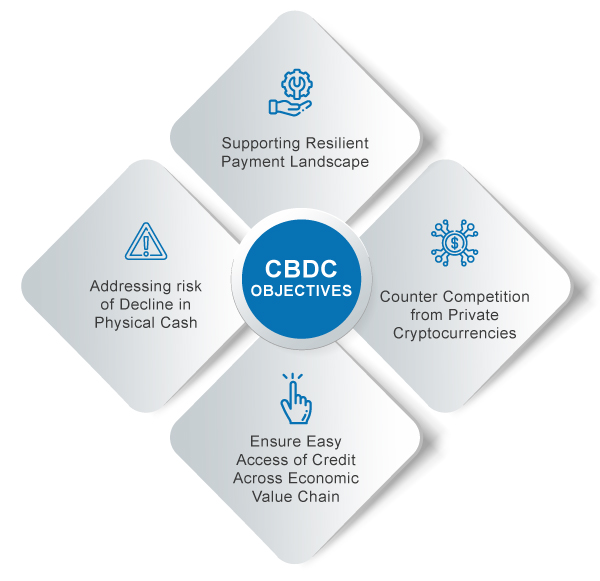

What are the Objectives of CBDC?

Difference between cryptocurrencies and CBDC

Below are high level differences between cryptocurrencies and CBDCs.

| CRYPTOCURRENCIES | CBDC |

|---|---|

| Privately Issued | Issued by central bank of a country |

| Not backed by any asset or reserves | Backed by reserves of central bank/government |

| Limited supply | Supply managed and controlled by central bank |

| Fully blockchain based | Can exist as blockchain based or just as system of records |

| Cryptocurrency mining is required to add new blocks to blockchain network | Mining process is not required to add new block to blockchain |

| Crypto mining involves huge computing power and resources | No such energy and resource requirements are needed |

| Can be enabled as permissionless or permissioned network | Usually enabled as permissioned network |

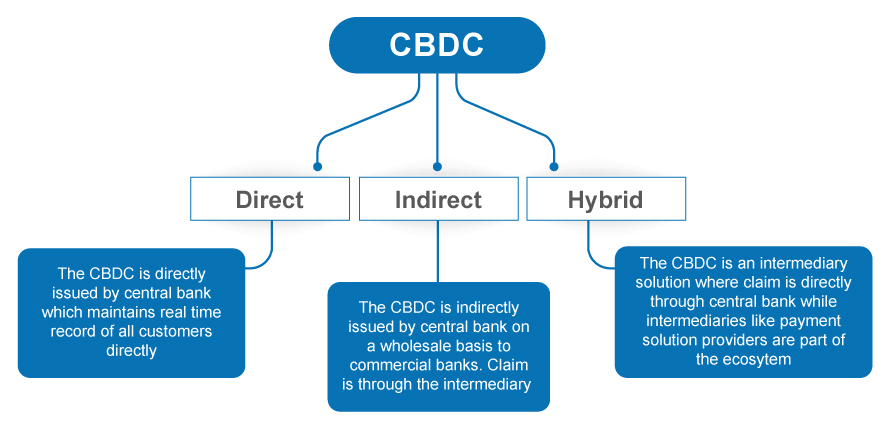

Types of CBDCs

Three types of CBDCs exist today

- Direct CBDC

- Indirect CBDC

- Hybrid CBDC

CBDC Operational Modes

CBDC can be operated in 2 modes

- Account based CBDC

- Token based CBDC

In an account based CBDC ecosystem, the central bank will hold accounts for all users of the CBDC wherein managing account reconciliation of all transactions that happen in the ecosystem. As the whole population is brought into the CBDC ecosystem, central bank will have tough time in maintaining the digital accounts of whole population.

In a token based CBDC ecosystem, the CBDC is created as a token with a specific denomination. The transfer of a token from one person/entity to another person/entity does not require reconciliation of two accounts (as against an account based CBDC which requires reconciliation). The transfer results in real time transfer of ownership similar to the physical cash exchange that exist today.

Project Dunbar

Oracle FLEXCUBE Blockchain Adapter

Oracle FLEXCUBE blockchain adapter enables Oracle FLEXCUBE (core banking solution) to interface to blockchain systems thereby facilitating easy transformation of information with minimal human/manual intervention. The adapter can be used with all versions of Oracle FLEXCUBE. In addition to connecting FLEXCUBE to blockchain platform, the adapter can connect other third-party applications to blockchain platforms.

How Profinch Can Help?

Profinch with significant years of experience in implementing Oracle FLEXCUBE across the world can help banks and financial institutions in their blockchain journey by connecting their FLEXCUBE core banking solution to the blockchain solution of their choice with help of Oracle FLEXUBE Blockchain adapter. Get in touch with us today!